child tax credit 2022 schedule

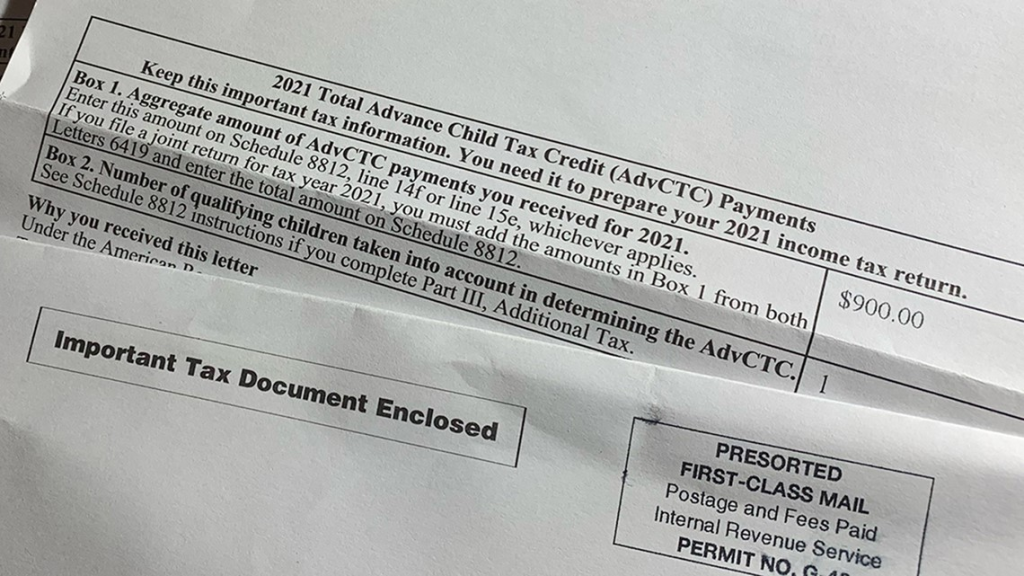

NJ Clean Energy- Residential New Construction Program. In january 2022 the irs will send letter 6419 with the total amount of.

The Child Tax Credit Newsroom News Events Community Action Partnership Of Utah

October 5 2022 Havent received your payment.

. The amount of the credit is smaller and eligibility is. The child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying child. Search Tax credits benefits business manager jobs in Piscataway NJ with company ratings salaries.

A payment of tax credits for the tax year 2022 to 2023. The amount of the credit is smaller and eligibility is. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility.

Todays WatchBlog post looks at our. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. You are eligible for a property tax deduction or a property tax credit only if.

Child Tax Credit Payment Schedule 2022. A state-level child tax credit worth up to 500 is available for the first time in New Jersey and Gov. 61 open jobs for Tax credits benefits business manager in Piscataway.

If youre received advanced child tax credit payments at any time during 2021 fill out Schedule 8812 and attach it to your return. A payment of tax credits for the tax year 2022 to 2023. Why file Schedule 8812.

The calculation of the child tax credit in 2023 will be different than in previous yearsAs inflation increases the credit amount will decrease. What recipients spent money on part one. You must report the monthly.

For more information about the Credit for Other Dependents see the instructions for Schedule 8812 Form 1040 PDF. Phil Murphy and lawmakers have officially moved up its effective date. 15 opt out by Aug.

Child Tax Credit 2021 Schedule Child. Have been a US. Child care tax credit 2022 schedule.

Child Tax Credit Payment Schedule 2022Irs started child tax credit ctc portal to get advance payments of 2021 taxes. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax. Child tax credit payment schedule.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit. TaX Credits located in Piscataway caters to residents in and around the Morristown area. Incentives depend on the HERS score and the classification.

The payments will be paid via direct deposit or check. The first child tax credit payment in july 2021 on its own the price of reverting to the old child tax credit for 2022 would be about 30. The maximum child tax credit amount will decrease in 2022.

December 13 2022 Havent received your payment. July 20 2022. As of now the child tax credit is worth 2000 per.

Click to call or view current TaX Credits promotions. According to the Center for Budget and Policy Priorities 91 percent of families making less than 35000 per year are using their. Child Tax Credit Payment Schedule 2022.

These IRS pages irsgovcoronavirusEIP and ChildTaxCreditgov have more information on how to complete and submit a tax return. Child Tax Credit Chart 2021. How much of the Child Tax Credit can I claim on.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2022 Monthly Stimulus Payment Schedule Who Qualifies Youtube

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

Child Tax Credit Payments What S Next

What You Need To Know About Advanced Child Tax Credit Payments Jfs

What Families Need To Know About The Ctc In 2022 Clasp

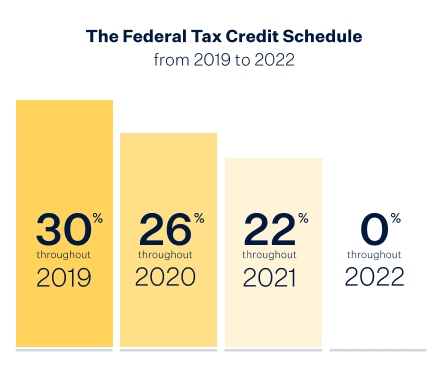

Solar Rebates 2021 Update Federal And Residential Solar Rebates Incentives Sunrun

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 How Much Will You Get